The cost consultant warns that project programmes are struggling with labour shortages causing delays, reducing productivity and creating operational bottlenecks.

The capacity crunch is increasingly constrained by the high level of insolvencies in the sector, further compounded by contractors’ across the industry taking a stand to be more selective in their approach to bidding new work.

In its Autumn market intelligence report, T&T said that while material cost volatility and overall tender price inflation have moderated, programme teams should be wary of asking suppliers to take on significant project risk through fixed-price contracts.

It warns that bids received will be risk-adjusted and more expensive. Also tender would more likely come from firms in greater need of securing turnover than those received for contracts offering a fairer risk allocation.

Martin Sudweeks, UK managing director for cost management at T&T, said they were advising clients to aim for more equitable transfers of risk and encourage the procurement of partners, not just suppliers, to enable better quality bids and enhance the working relationship with the supply chain.

He said the firm was also highlighting the benefits of contracting directly with second tier suppliers to improve visibility and control costs, as well as the importance of incentivisation to boost performance.

“It is encouraging to see confidence in the sector beginning to return as we find some relief in the form of lower interest rates and a rise in new orders.

“However, despite the cooling of tendering conditions and general weakness of the construction sector, this is far from a buyer’s market and businesses will need to be careful about how they manage risk to deliver major programmes successfully.

“As we head towards the Chancellor’s budget this Autumn, organisations should be looking to establish sophisticated commercial models that can balance the risk and reward for both the client and suppliers.

“Careful apportioning of risk, while promoting incentivisation and collaboration, will be the keys to success as we deliver the next generation of transformative real estate and infrastructure projects for the country.”

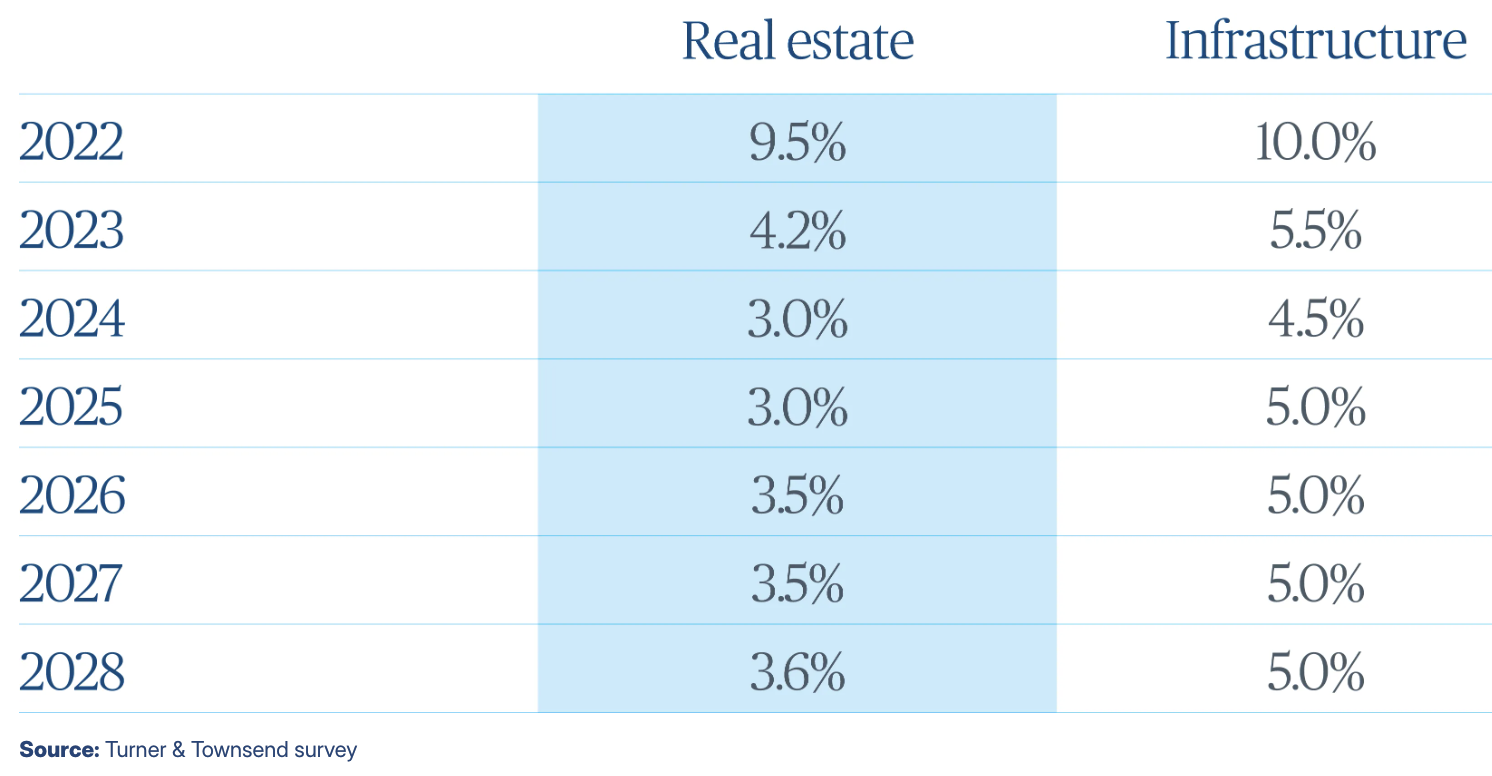

The publication reports more positive business sentiment and holds firm with its tender price inflation forecast, with building and infrastructure landing at 3% and 4.5%, respectively.

Tender price inflation forecast