Most people feel secure putting their money into “safe” options like fixed deposits or recurring deposits. But according to Chartered Accountant Nitin Kaushik, this sense of security might actually be costing you a fortune in the long run. He calls it the “Return Gap Trap”—a costly mistake that stems from prioritising stability over growth.

Let’s break it down with a real-world example.

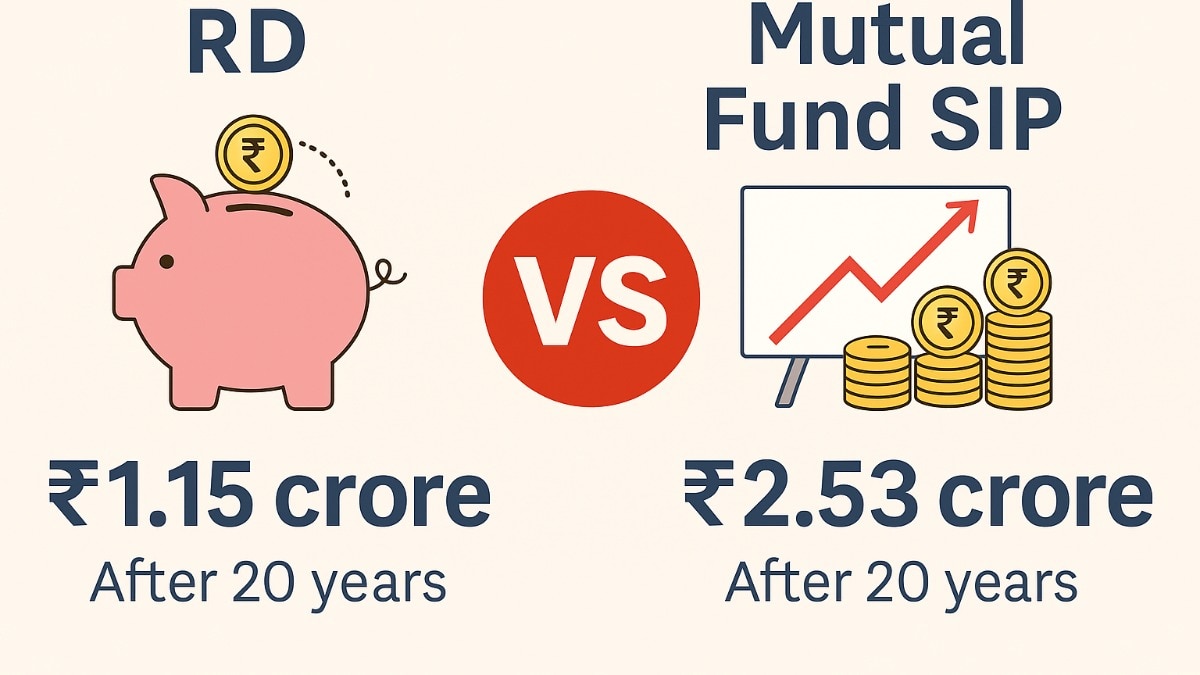

Imagine you invest Rs 25,000 every month for 20 years. That’s a total outflow of Rs 60 lakh over two decades. Now, depending on where you choose to park this money, your future wealth can look very different.

Option 1: Recurring Deposit (RD)

A bank recurring deposit currently offers around 6% annual return. Over 20 years, your Rs 25,000 monthly investments would grow to around Rs 1.15 crore. It’s predictable, low-risk, and feels reassuring.

“But is it smart?” Kaushik asks. “You’re locking away money for 20 years, and the final outcome is just a little over what inflation might eat up.”

Option 2: Mutual Fund SIP

Now, consider putting that same Rs 25,000 into a Systematic Investment Plan (SIP) in mutual funds, earning a conservative 12% compounded annual growth rate (CAGR)—a reasonable expectation for long-term equity investments. In this case, your corpus after 20 years would be Rs 2.53 crore.

That’s a staggering difference of Rs 1.38 crore.

This gap, Kaushik explains, is the Return Gap Trap—the financial damage caused not by market crashes or bad investments, but by sticking to low-yield instruments for long-term goals.

Why It Matters

“In finance, what feels right can often cost you the most,” says Kaushik. “People overestimate stock market risk and underestimate the cost of not participating in higher-return avenues.”

Over two decades, that Rs 1.38 crore difference could fund your child’s foreign education, buy a home, or even fast-track your retirement. It’s not just about missed returns—it’s about missed life opportunities.

Advice for you

Kaushik isn’t dismissing RDs or fixed deposits altogether. “They’re great for short-term goals or emergency funds. But they’re not wealth creators,” he says.

Here’s what he recommends:

Use RDs/FDs for short-term needs or emergencies

Invest long-term money in growth-oriented instruments like equity mutual funds

Start early, invest consistently, and embrace market volatility as part of the process

The power of compounding works best over long periods, and every year lost to “safe” investing is wealth you’ll never recover.

What should investors note?

Safety has its place—but wealth is built through growth, not just protection. In the long run, the costliest mistake is not losing money—it’s not letting your money grow at all. So before you lock away your future in low-return products, ask yourself: what is that “safety” really costing you?