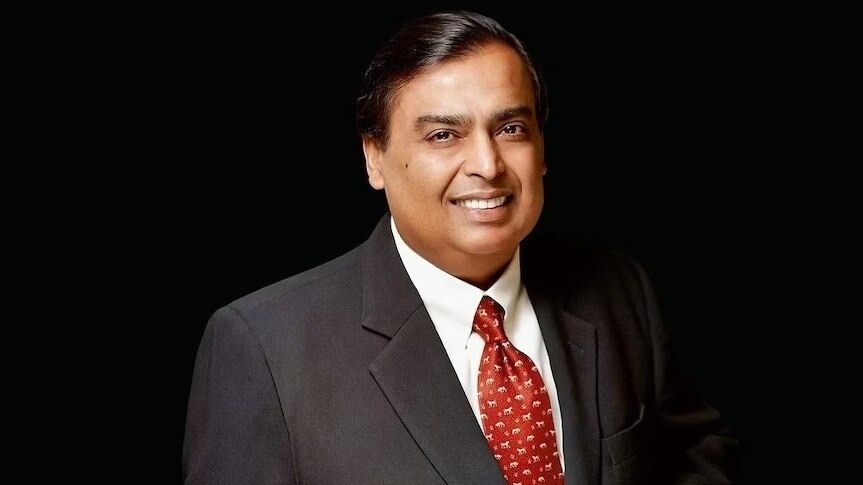

Mukesh Ambani has described Reliance Jio’s early days as the company’s boldest and most meaningful risk, calling the $25 billion bet not just a business decision but potentially the “best philanthropy” Reliance could have done for India.

Asked by McKinsey senior partner Gautam Kumra about the high-stakes nature of the investment, Ambani noted how the funding came entirely from within Reliance. “It was our own money that we were investing, and I was the majority shareholder.”

The context then was stark: India’s telecom landscape was fragmented, mobile data was expensive, and internet penetration was limited. Many analysts doubted whether a nation of over a billion people was ready for high-speed digital infrastructure. “Our worst-case scenario was that it might not work out financially,” Ambani admitted. “Some analysts thought India wasn’t ready for the most advanced digital technology.”

Yet the Reliance chairman remained undeterred, driven by a longer-term vision. “I told my board, ‘In the worst case, we will not earn much return. That’s okay because it’s our own money. But then, as Reliance, this will be the best philanthropy that we will have ever done in India because we will have digitised India, and thereby completely transformed India.’”

That transformation is now evident in both financial and societal terms. Jio launched its mobile services with free data and voice calls in 2016, forcing a complete reset of the Indian telecom sector. Within months, it had acquired over 100 million users, and by 2024, Jio had grown to over 470 million subscribers, according to the Telecom Regulatory Authority of India (TRAI).

The platform’s valuation has also skyrocketed. In 2020, during the height of the COVID-19 pandemic, Reliance raised over $20 billion for Jio Platforms Ltd. from global investors including Facebook (now Meta), Google, Silver Lake, and KKR. These deals valued the company at over $65 billion at the time. By late 2023, analysts at Jefferies and CLSA estimated Jio’s valuation to be in the range of $95–100 billion, factoring in its growth across 5G, broadband, and digital services.

Jio has since expanded far beyond telecom. It now operates broadband (JioFiber), enterprise-grade cloud infrastructure (through partnerships like Jio-Azure with Microsoft), and even financial services via Jio Financial Services, which listed on Indian exchanges in August 2023. According to a March 2025 ICICI Securities report, Jio is expected to contribute nearly 50% of Reliance Industries’ total EBITDA by FY26.

The societal impact of Jio has been just as profound. India has become the world’s largest consumer of mobile data, with per-user data consumption exceeding 32 GB per month, per the latest edition of Ericsson’s Mobility Report in June 2025. Cheap and accessible internet has enabled millions to participate in digital commerce, online education, healthcare, and e-governance.

Ambani’s reflection on the risk Jio posed, and the purpose it ultimately served, sums up a broader leadership philosophy: one where financial gain and nation-building are not mutually exclusive. “For us, scale is important,” he said, “and with Jio, we knew we were betting on India’s future. That’s a risk worth taking.”